“Risk means more things can happen than will happen.”

-Elroy Dimson

I was with my friend, Srinivas, in one of the isolated places of the US earth, hot and humid, in Seymour, Texas.

This trip with Srinivas, was an adventure, a week’s vacation, a search of life through little difficulty in a slightly different way.

My chemistry with Srinivas was pretty solid and exploratory for many reasons over the years.

We have known each other for many years, as we both are scientists in two different companies and very interested in philosophy and psychology.

Mandeep was an overall man of the motel in the isolated place, where we’re staying in Seymore, Texas.

I’d noticed Mandeep back in 2020 on my first night in the same motel as I’d stayed there eating my dinner.

It was my second time there staying in the same motel, and this time I was with Srinivas.

Mandeep, though, hadn’t looked exciting enough even to his job, at least for me. He’d seemed utterly and profoundly pale, a lanky tall man somewhere in his fifties, as quiet as the isolated Seymour motel itself.

He was serving us ice water and some snacks.

I asked him, “how did you end up here?”

He said, “I was a stock trader all in my twenties and thirties.”

“What kind of stocks did you trade?” I asked, expecting to say something about trading stocks.

“I traded financial sectors and real estate,” he replied simply with no excitement. “I was one of the crazy risk takers, I lost my home and all of my balance.”

As he said that, I remembered the lines from a great investor, “greed, fear, envy, ego, and capitulation are our common human characteristics. They compel us to take action when it is shared by the herd.”

Mandeep told us how he’d graduated from Upenn, Philadelphia in the early 2000s.

Here, in the middle of nowhere, serving plates, cleaning and changing bed sheets, was a guy who’d lost everything in his life by trading stocks.

I asked again,”how did you start trading?”

When he was a kid, he said, his father used to skip the sports page of the newspaper and directly go to the finance section.

His father said to him, “if you’d owned a share of this company yesterday, you’d have $1 more today than yesterday. The stock went up automatically. “

I was 14 years old and I asked my dad, ” Can I make money without work?”

My dad said “yes, but you have to know the stock to make money. If you don’t know stock, you won’t make money, you’ll lose money.”

“Well, I wanted to make money without any work but never studied stock, so here I’m now, I couldn’t understand what my dad was teaching me,” he said.

I realized with amusement how unpredictable our life is.

The world really is stranger and unpredictable than we could imagine.

The funniest thing about life is we don’t know what will happen tomorrow, or the day after tomorrow, or a week from today.

I asked him again, “So why’re you here in this place?”

Mandeep shrugged.

“After losing everything that I had, God again played another game to me,” he added.

A car accident in New Jersey killed his wife and two children, he said quietly looking over the ceiling.

His own head was injured so badly that he became normal after 3 years, his trading business was over.

“I needed to get out of New Jersey,” he said.

“This motel owner needed a helper and I needed a job in isolation, far away from my own place in New Jersey,” he said without a trace of self-pity. “So here I’m.”

“When I look back on my life, I was one of the crazies. I was an obsessive, addictive, maniacal, masochist risk taker, I wasn’t only a risk taker actually, I was a freak trying to become a millionaire overnight,” he expressed softly.

“I would buy today and sell tomorrow, my risk was heavily concentrated with the time horizon. I always acted in anticipation of market prices rather than market prices after they occurred.”

“But no regret now, the only thing is my wife and my two children’s faces suffocate me sometimes at night during sleep,” he became emotional.

“I cry because I feel good when I cry occasionally, I also feel sorry for myself,” he added.

I couldn’t sleep well that night.

I was awoken, mainly catalyzed by Mandeep’s life. Sorting through his memories also made me see something inside human life.

Getting up from a complete loss personally and professionally is an act of pure faith.

I didn’t really know how Mandeep’s mental crisis would end, but I’d believed he could find an answer.

It was another paradox of life, by getting up from a devastating loss, we find out how to get going. By believing that an unseen source of strength exists, it becomes the new source of survival.

Mandeep is acting as though he is among the losers, and perhaps he will eventually be the winner.

When Mandeep said he was a crazy risk taker, I remember a story, one of my teachers shared with me many years ago about a gambler.

I was an undergrad back then.

One day a gambler heard about a horse race with only one horse in the race competition, so he bet all of his borrowed money on it. Halfway around the track, the horse jumped over the fence and ran away.

Think about the mind of the gambler, what he’d thought before betting on the horse and what actually happened.

I’d seen similar experience a few years ago. One of my friends bought a brand new car, paid money, and finished the paper work at the dealer. So he finally drove the car and headed towards his home. Immediately after he made exit from the dealer, he was hit by another reckless driver and got into a crash. Fortunately, he got only minor injuries but his brand new car got damaged completely.

The essence is, there is nothing guaranteed in our life, there is almost nothing without risk in our life because risk is invisible.

Risk is always associated with future events, it’s impossible to know for sure what the future brings.

Mark Twain expressed it best, “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

There is a very diplomatic word the legal system uses all the time.

Rebuttable presumption, that clearly indicates something that should be presumed to be true until someone proves otherwise.

So, risk in our life is exactly the rebuttable presumption.

Up until now I’d generally agreed with the modern view of the world that faster is better and faster comes only with risk. If we need anything faster it means it is riskier. It’s the basic premise of the twenty-first century: Risk is exciting and futuristic, we should take more risks. Secureness is stodgy and archaic.

Risk is like Zen, which teaches that all enlightenment comes through stillness of the mind and the body. This lack of motion is not a measure of idleness but strength, discipline, focus, and character.

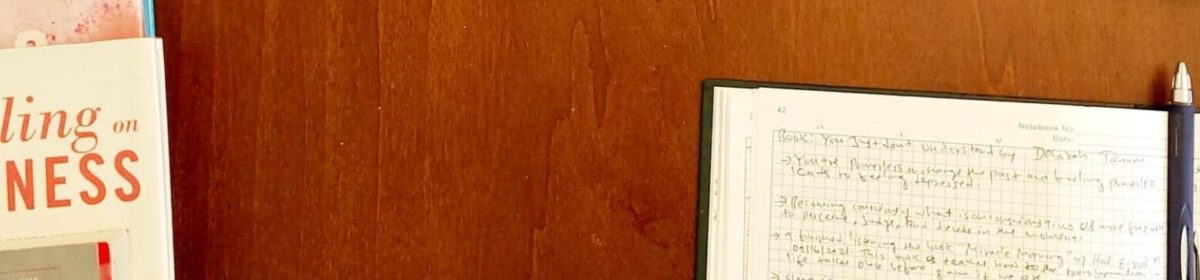

After reading “Zen in the Art of Archery,” I clearly understood what the target means in our lives. Target is only the perfect release of the arrow, and then we must stop thinking. When we perfect the release without conscious thought and expectation, we achieve an archer’s place of perfect calm and that perfect calm, of course, leads to perfect accuracy.

Risk is another name of perfect calm in our lives but calmness is required to evaluate the risk in advance.

Calmness leads to deeper thinking, a secondary thinking, which is different from many others.

Deeper thinking doesn’t count emotions, it only counts reality.

Risk takers are among the last great champions. The success and failure in risk taking is a measure of our moral fiber. Recreational risk taking does equalize everyone out. A rich man’s wallet only weighs him down when he becomes a reckless risk taker, and a poor man can beat him by accepting calmness on risk. The real task doesn’t mean we shouldn’t take risks but to give many second thoughts on them properly through slow thinking.

Life is unpredictable, we have to accept the inevitability of change, we have to accept the rise and fall of things in life. Our life will run in phases, many things will come and go, things will appear and disappear.

Our environment will change in many ways beyond our control.

We must recognize, accept, cope, and respond to the change.

I learned the same lesson from Mandeep’s life.

Life is easier than we think but harder than it looks.

But, still, the greatest use of life is to spend it on something that will outlast it, I still think Mandeep is on the same path.

He had two kinds of risks, one he could control or minimize in some ways, but the other probably not.

Therefore, our life juggles around various kinds of risks, always, everyday, and every moment.

We always overestimate what we’re capable of knowing and doing, this is very dangerous to pursue.

What happens if the surgeon is overestimating the heart surgery and the runner is overestimating the marathon?

We have to accept our limitations of what we know and working within those limits provide us with a different leverage rather than going beyond our limits.

Although we feel many emotions, we must not succumb. We must recognize emotions and stand tall against them.

Our reasons are always greater than emotions, that’s how we pause and study risks.

By studying risks, we don’t stop them but we become more aware of their consequences.

Again, there is a big difference between knowing the path and walking the path.

Knowing is a method booklet but walking is a thinking booklet.

Risk in our lives is the composite mixture of both.

Risk is really a question of common sense and balance. Finding the right balance between educating about risk involved and then knowing when to take action is, in fact, a key element of human survival.

Howard Mark’s said beautifully, “we never know where we’re going, we ought to know where we are.”

Thank you for your time.

-Yam Timsina

Skip to content

Progress for valued society